The short-interest ratio measures the number of days it would take all short-sellers to exit their positions based on the average daily trading volume. It weighs the amount of short interest against the stock's average daily trading volume. Short-Interest RatioĪnother important metric to look at when trying to identify stocks where a short squeeze may occur is the short-interest ratio. If a large percentage of a stock's shares are sold short, there is a chance of a short squeeze occurring if the price rises suddenly. Short interest is important because it reveals how investors feel about a particular stock. Short interest refers to the percentage of outstanding shares that are being sold short. Investors should keep an eye out for stocks with high short interest.

To identify stocks where a short squeeze may occur, investors can look out for several things, including the following.

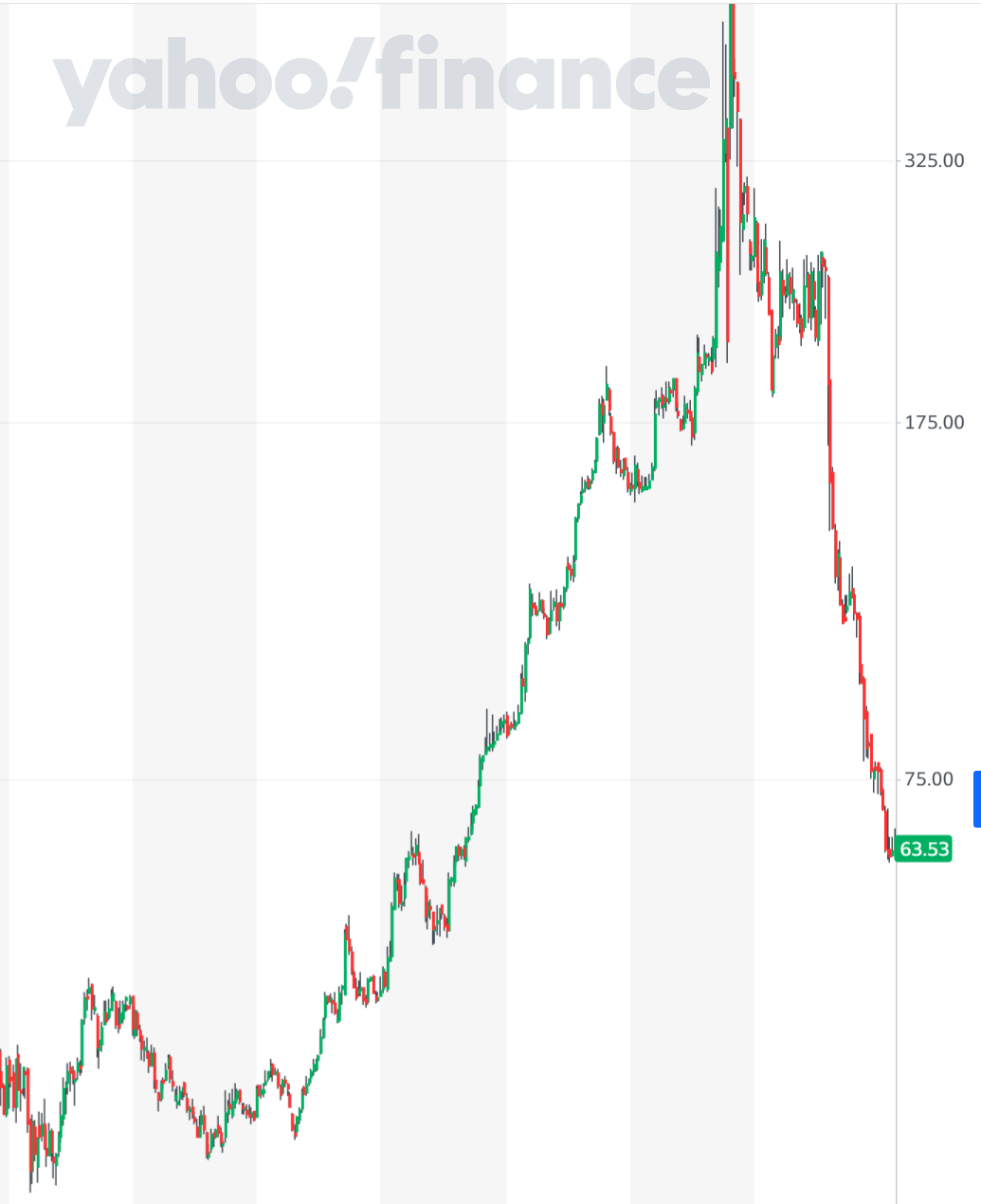

The result is an even higher and higher stock price until the short interest is tapped out. Those purchases send the stock price even higher, causing more short-sellers to cover their positions. Key Takeaway: As the price climbs, some short-sellers may feel the heat and decide to cut their losses, so they buy shares to cover their position. Sometimes a short squeeze convinces other investors to buy, sending the price up even further. As more and more short-sellers are forced or decide to cover their positions by buying the stock, the price rises higher and higher. When there's a large amount of short interest in a stock, a short squeeze can be triggered by something as simple as a positive earnings report or news headline. Many stocks that enter a short squeeze have a relatively small number of outstanding shares and a small market capitalization, although short squeezes can also occur in larger stocks, putting billions of dollars on the line. Now, any positive catalyst in such a situation may cause short sellers to start panicking leading to increased buying of the stock as the short sellers begin to cover their positions. In order for a short squeeze to occur, there must be a large number of short-sellers that together hold a significant number of shares short. The squeeze creates a positive feedback loop that sends the stock price higher and higher. How a Short Squeeze HappensĪ short squeeze occurs when the price of a stock with a significant amount of short interest, is surging. Short-sellers exit their position by purchasing shares to return to the lender. When this happens, the short-sellers are squeezed out of their position, being forced to buy shares at a loss. However, if the stock price increases a lot in a relatively short amount of time, they may cut their losses by buying shares at the higher price. Short-sellers borrow shares and sell them because they expect the price to fall, enabling them to pocket the difference between the price at which they borrowed and sold the shares and the price at which they buy the shares later. However, if the price rises instead of falls, a short squeeze can occur. The best-case scenario is that the price falls, so the short-seller can buy the shares for a lower price than what they sold them for when they borrowed them. At some point in the future, they must buy shares so that they can return them to the lender. They sell those borrowed shares at the price the stock was at when they borrowed them. When an investor sells a stock short, it means they have borrowed shares at what they hope is a high price. Gguy44/iStock via Getty Images What Is Short Selling?

0 kommentar(er)

0 kommentar(er)